People can buy now, pay later at top children’s clothing company Hanna Andersson

People can buy now, pay later at top children’s clothing company Hanna Andersson

NOTE: As of August 1, 2021, StagedPayTM is now known as Clever DivisionTM, a new, upgrade version of the innovative, patented software.

San Antonio, Texas – When COVID-19 swept the globe in March 2020, it changed the way we shop. Today, many businesses are still closed and people are avoiding public places. The changes have driven online sales to a record $73.2 billion in June, up 76.2% from last year, according to Digital Commerce 360. A new study finds many consumers plan to continue shopping online even when brick-and-mortar stores reopen.

The pandemic has also forced retailers to adapt and meet the needs of their new online shoppers. One business leading the way is the popular high-end children’s clothing company Hanna Andersson, based in Portland, Oregon.

The business turned to software company Red Maple™ to provide them with new methods of payment that are fast, easy and secure. Texas-based Red Maple specializes in developing turnkey solutions for retailers.

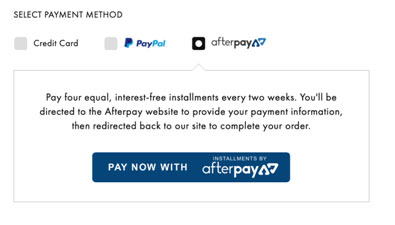

Before the pandemic, Hanna Andersson accepted traditional credit card payments and PayPal. Now, the retailer is expanding its payment options.

Red Maple worked with Hanna Andersson’s team to develop and implement a new payment solution called Afterpay.

Afterpay allows customers to “Buy Now and Pay Later” (BNPL). According to Digital Media Solutions, BNPL is considered “today’s version of layaway” and has increased in popularity due to COVID-19. With Afterpay, Hanna Andersson can offer customers an installment plan with four interest-free payments over an eight-week period. It allows shoppers a more budget-friendly option for shopping. Red Maple is also working with Hanna Andersson to set up Apple Pay, which it will soon offer to customers.

In addition to providing a full suite of credit card and payment solutions, Red Maple offers top security for retailers and their customers, as the FBI reports cyberattacks have spiked 400% since the coronavirus outbreak. Red Maple’s solution is StagedPay™, a hosted credit card solution that uses two-step authentication for merchants to process secure payment transactions.

“With more people online during this pandemic, breaches and hacks have sky-rocketed. We read about new cyberattacks every day in the news. StagedPay™ is a game changer in the retail industry, now more than ever,” said Patrick Hodo, CIO of Red Maple.

StagedPay works like a combination lock by allowing merchants to accept and process credit cards using only part of the card number. To open that lock and complete the purchase, the customer must enter the remaining numbers on the secure StagedPay site via text, email, or phone. The merchant is notified when the order is authorized and complete.

This two-step process means the merchant never collects the full credit card number and is not vulnerable to data breaches and theft. StagedPay also allows the credit card information to be tokenized and inserted into a company’s ERP system to be re-used securely for future transactions.

For more information about Red Maple and StagedPay, contact Diane White at Diane@DianeWhitePR.com or call 918-770-3905.

About Red Maple

Red Maple™ specializes in developing turnkey solutions that natively expand the capabilities of Dynamics 365 for Operations. Globally deployed by 500+ companies, Red Maple’s solutions support complex business processes for credit cards, commissions, recurring billing, revenue recognition, and more. The company’s Advanced Credit Cards for F&O and BC enables businesses to securely accept and process credit card payments using native integration without hidden costs. Using pre-integration with multiple processors and gateways, Red Maple provides an omni-channel experience with processing from native client, Retail (mPOS/ePOS) and integration with numerous e-commerce engines.